GST payment

This is the 28th of the month after the end of your taxable period. Give it a Try.

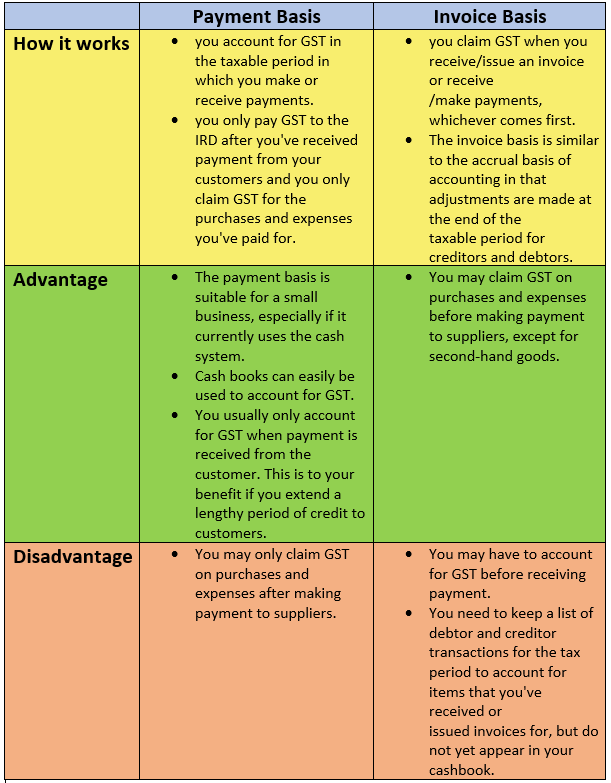

Gst Payment Vs Invoice Basis The Career Academy Help Centre

Grievance against PaymentGST PMT-07.

. PdfFiller allows users to Edit Sign Fill Share all type of documents online. Tax refunds made via PayNow receiving GST and Corporate Tax refunds and GIRO will be received within 7 days from the. OTTAWA ON Nov.

January 5 2022 April 5 2022 July 5 2022 October 5 2022 The extra GST benefit will be paid starting on November 14 2022. Ad Keep Your Competitive Edge with Robust Payments and Hedging Solutions. 3 hours ago234 no children 387 with 1 child 467 with 2 children 548 with 3 children 628 with 4 children Married Canadians or those who have a common-law partner can.

8 hours agoThe maximum payment you could receive if you are married or have a common law partner. You could receive a maximum payment of up to. Typically GSTHST credit payments are made on the fifth day on or before of July October January and April.

And in 2023 the payment dates. Generally tax credits of at least 15 are automatically refunded. On Any Device OS.

If you do not receive your GSTHST credit. On the GST portal go to the Services option. If you are single 234 no children 387 with 1 child 467 with 2 children 548 with 3 children 628 with 4 children If you are married or.

1 day agoDoubling the GST Credit for Six Months. Payment dates The Canada Revenue Agency usually send the GSTHST credit payments on the fifth day of July October January and April. 306 if you have no children 387if you have one child 467 if you have two children.

GST payment process mostly remains the same for all taxpayers under GST. The payment amount is calculated based on an individuals family situation in October 2022 and on their 2021 tax and benefit return. 4 2022 CNW Telbec - The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the.

In 2022 the payment dates are as follows and are based on your 2020 return. For example the taxable period ending 31 May is due 28 June. If there is a sufficient cash balance in the electronic cash ledger then payment is not required.

Quarterly if your GST turnover is less than 20 million and we have. Goods and Services Tax. Now provide a GSTINother ID and click on Proceed.

In the coming weeks an estimated 11 million low- and modest-income people and families will receive an additional Goods and Services Tax. What are the simple steps for GST payment online. Monthly if your GST turnover is 20 million or more.

Your GST reporting and payment cycle will be one of the following. Note that July 2022 to June 2023 payment will be the start of a new calendar year for GST payments and it will be based on your 2021 tax returns. Your GST payment is due on the same day as your GST return.

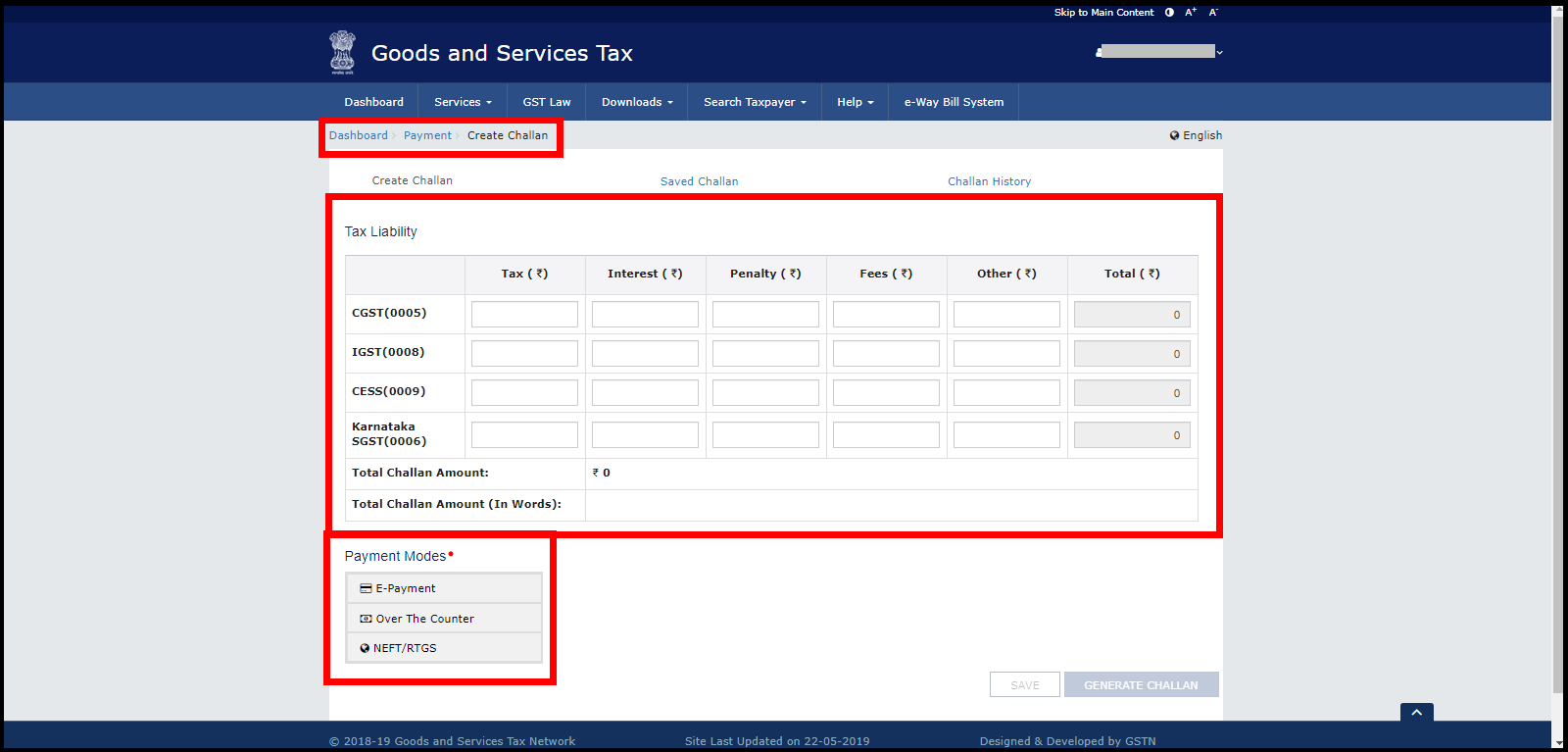

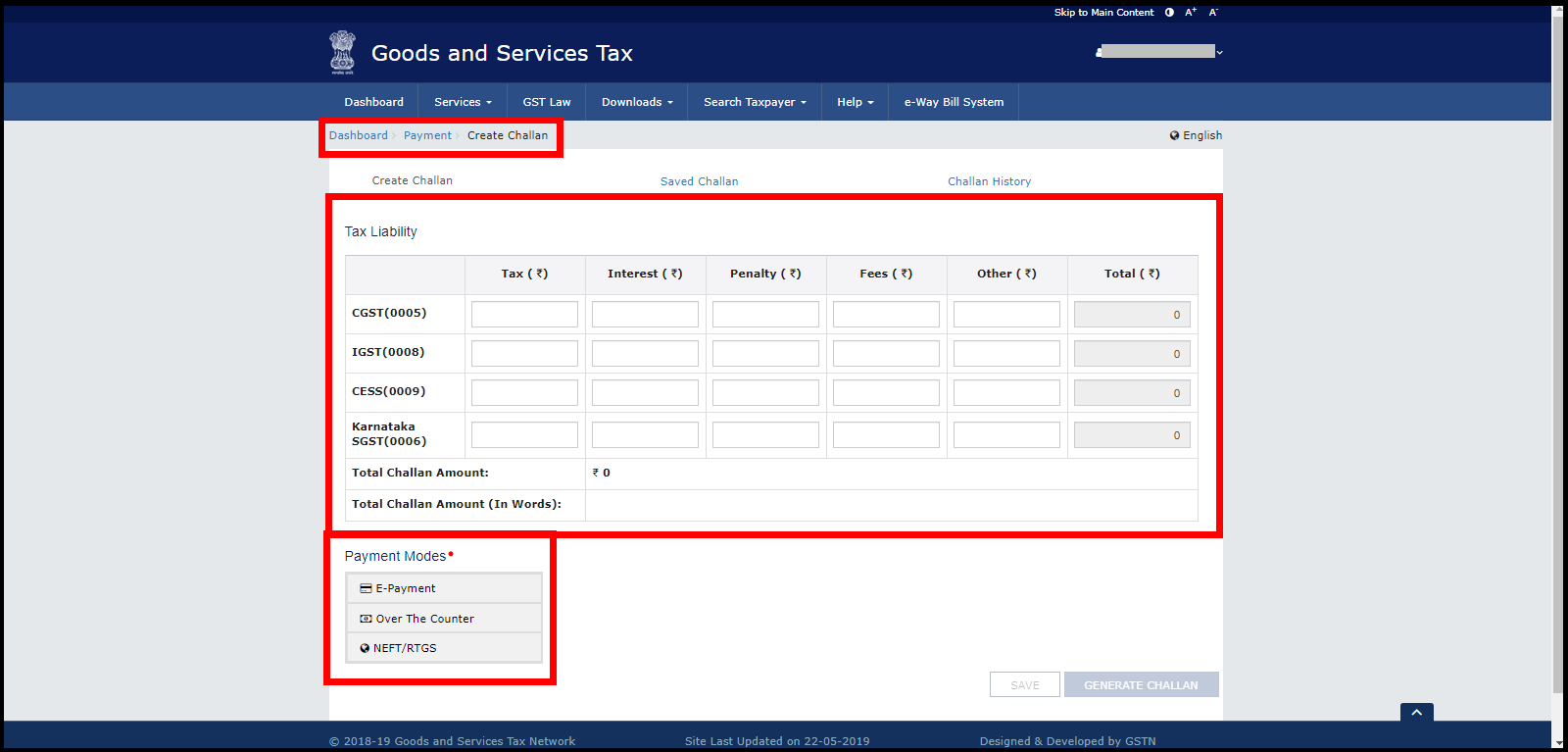

Eligible families and individuals could. GST payment dates for 2022 fall on. From Payments option below it select Create Challan.

Payment Technologies Foreign Exchange Strategies Industry Solutions. Allow up to 10 working days before you contact CRA if you. For the 2021 base year.

First step- login to the GST portal The second step- go to the Services menu PaymentsCreate challan or direct create.

How To View Challan Reconciliation Report In Tallyprime Tallyhelp

Gst Challan View Or Edit Saved Gst Challan Learn By Quicko

Payment Mechanism Under Gst Regime File Taxes Online Online Tax Services In India Online E Tax Filing

Due Dates Of Gst Payment With Penalty Charges On Late Payment

Good News Gst Taxpayers To Get Flexibility To Decide On Monthly Tax Payment Zee Business

Gst Challan Payment Process To Pay Gst Online Learn By Quicko

Gst Online Payment Process Mybillbook

How To Make Gst Payment Gst Payment Process Gst Create Challan

Gst Payment Everything You Need To Know About Gst Payments

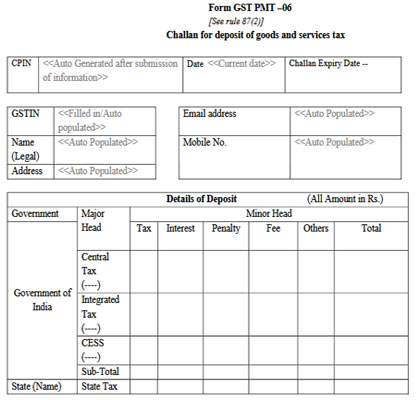

Gst Challan Payment With Pdf Format And Download Process

Steps For Gst Payment Challan Through Gst Portal

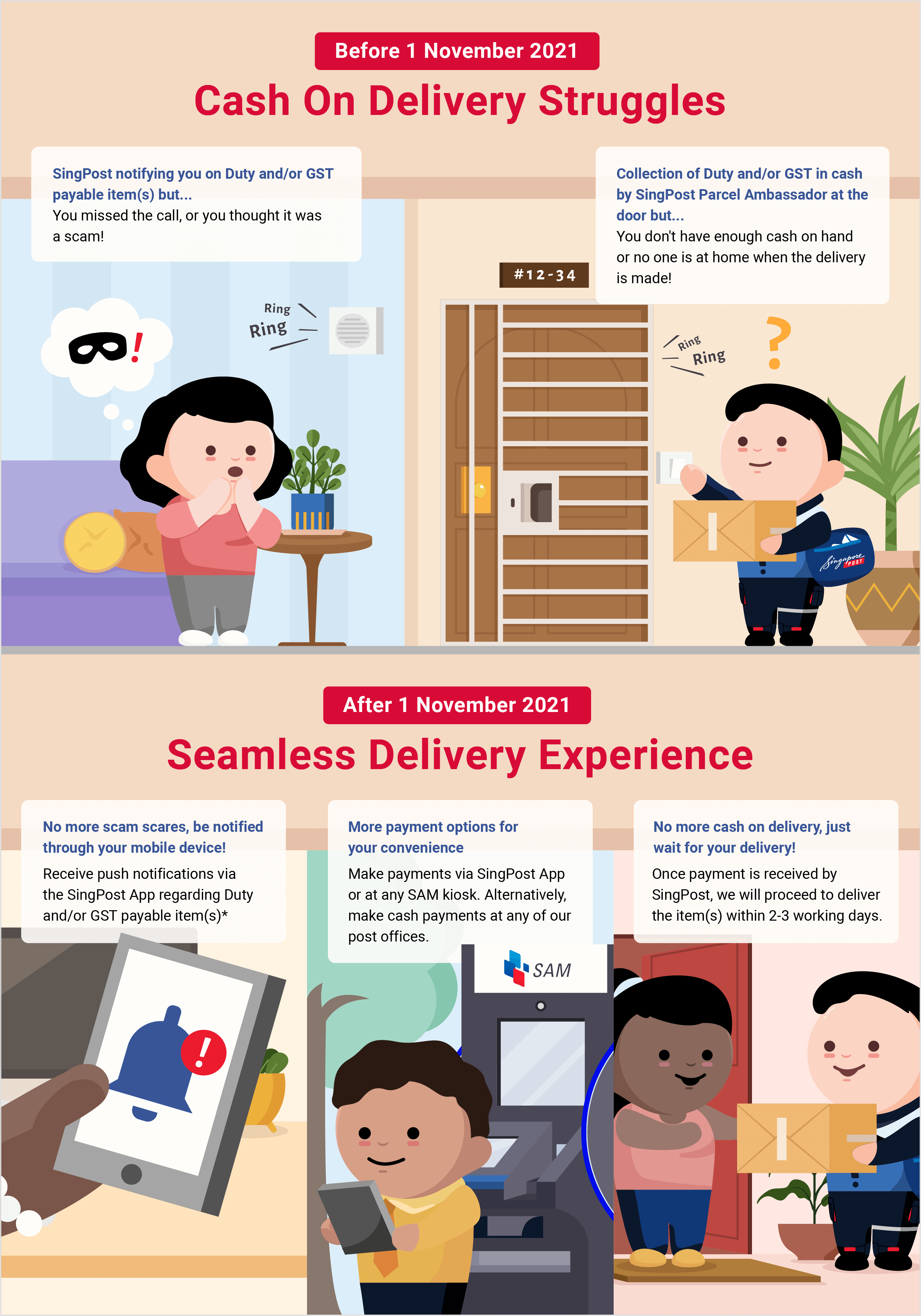

Gst Duty Payment Singapore Post

Gst Hst With Early Payment Discounts And Late Payment Penalties Djb Chartered Professional Accountantsdjb Chartered Professional Accountants