what state has the highest capital gains tax

California taxes capital gains as ordinary income. The federal government taxes income generated by wealth such as capital gains at lower rates than wages and salaries from work.

Made A Profit Selling Your Home Here S How To Avoid A Tax Bomb

New Jersey follows with 14 to 1075.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. States With the Highest Capital Gains Tax Rates. California taxes capital gains as ordinary income. Download State Real Estate Capital Gains Rate Chart log-in required to learn what your states capital gains tax rate.

The highest-income taxpayers pay 408 percent on income from work but only 238 percent on capital gains and stock dividends. States With the Highest Capital Gains Tax Rates. Im always fascinated to see Chinese investors flocking to buy homes in.

Among these changes was an increase in the federal top marginal capital gains tax rate from 238 percent to 28 percent. Long-Term Capital Gains Taxes. And this is a decrease from what it once was.

Denmark 42 to 59. 75 until Proposition 30 expired. A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit.

Indeed Alaska lets localities charge local sales taxes. The highest rate reaches 11. California taxes capital gains as.

As of 2021 the long-term capital gains tax is typically either zero. Capital gains tax rates on most assets held for a year or less correspond to. States With the Highest Capital Gains Tax Rates.

States With the Highest Capital Gains Tax Rates. California taxes capital gains as. In Alabama the highest capital gains tax rate was five percent on capital gains.

The nine states with no personal income tax Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming have the lowest rate in the United. Capital gains taxes are paid at the time of sale of an asset ie. The 10 states with the highest capital gains tax are as follows.

Kansas also has an intangibles tax. 57 on more than 30000 of taxable income for single filers and more than 60000 for joint filers. As of May 2018 Guam has the highest maximum rate at 20 percent whereas North Dakota has the lowest maximum rate at 29 percent.

California United States 33. The 10 states with the highest capital gains tax are as follows. In the states that do not use income brackets North Carolina has the highest tax rate at 525.

The state with the highest top marginal capital gains tax rate is California 33 percent followed by New York 315 percent Oregon 31 percent and Minnesota 309 percent. The list focuses on the main types of taxes. Youll owe either 0 15 or 20.

The state with the highest top marginal capital gains tax rate is California 33 percent followed by New York 315 percent Oregon 31 percent and Minnesota 309 percent. Indeed Californias top tax rate of 133 percent -- if merely added to the top federal capital gains rate of 238 percent thats the 20 percent base. 19 rows State.

Californias state-level sales tax rate remains the highest in the nation at 725 as of 2021. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. In the United States of America individuals and corporations pay US.

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap. Combined with local sales taxes the rate can reach as high as 1025 in some California cities although the average is 868 as of 2021. Short-term capital gains are taxed at the investors ordinary income tax rate and are defined as investments held for a year or less before being sold.

The highest rate reaches 133. The states with the lowest average combined state and local sales tax rates are Alaska 176 Hawaii 444 and Wyoming 522 while. At the other end of the spectrum California has the highest capital gains tax rate at a whopping 133.

Some States Have Tax Preferences for Capital Gains. That means there is more than a 50 difference between taking a large capital gain. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

And this is a decrease from what it once was. The state with the highest top marginal capital gains tax rate is California 33 percent followed by New York 315 percent Oregon 31 percent and Minnesota 309 percent. 5 US States and Countries with the Highest Capital Gains Taxes 1.

Corporate tax individual income tax and sales tax including VAT and GST but does not list capital gains tax. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and the amount of time the investment was held. Hawaii taxes capital gains at a lower rate than ordinary income.

If there was one country that could beat out the high tax rates in The Land of the Free. Maine has the highest starting tax rate for the lowest income bracket at 58 but it only goes up to 715. The lowest rate of 25 percent is shared among the nine states with no personal income tax Alaska Florida Nevada New Hampshire South Dakota Tennessee.

Breaking this down further the states with the highest top marginal capital gains tax rates are California 33 percent New York 316 percent Oregon 312 percent and Minnesota 309 percent.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

Capital Gains Tax Capital Gain Integrity

Tax Breaks For Capital Improvements On Your Home Houselogic

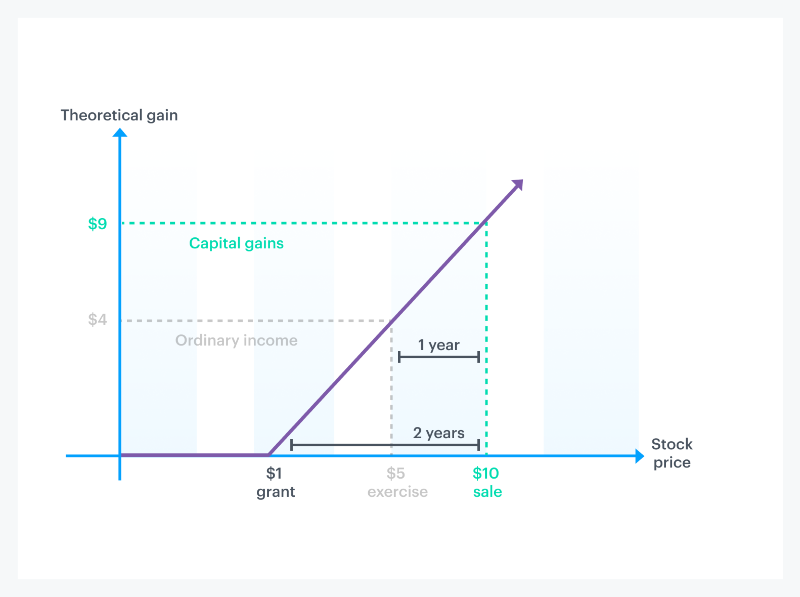

How Stock Options Are Taxed Carta

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Do State And Local Individual Income Taxes Work Tax Policy Center

The Average Household Income In America Financial Samurai

2021 Capital Gains Tax Rates By State Smartasset

Selling Stock How Capital Gains Are Taxed The Motley Fool

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)